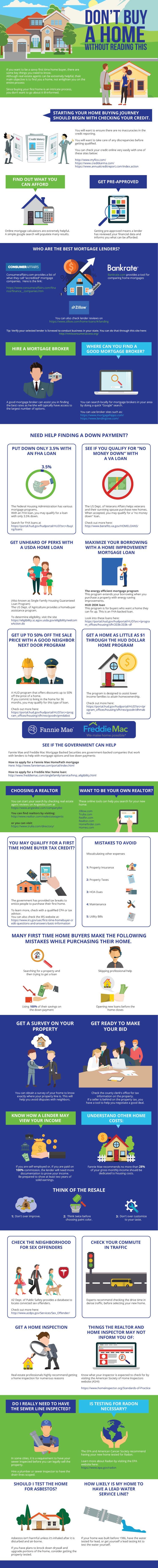

If you want to be a savvy first time homebuyer, there are some key things you need to know.

Although real estate agents can be extremely helpful, their main objective is to find you a home, not enlighten you on the entire process.

Since buying your first home is an intricate process, you don’t want to go about it ill-informed.

This article will provide you with keen insight, to help you become a more well-informed first time home buyer.

I have a section for you with insight of 4 things you MUST look for in your home inspection that your realtor and home inspector may not tell you, later in this post…

But for now, follow these tips:

Starting your home buying journey should begin with checking your credit.

Knowing your credit score isn’t good enough. You will want to ensure there are no inaccuracies in the credit reporting. You’ll want to take care of any discrepancies before getting qualified. You can check your credit online very easily with one of these sites below:

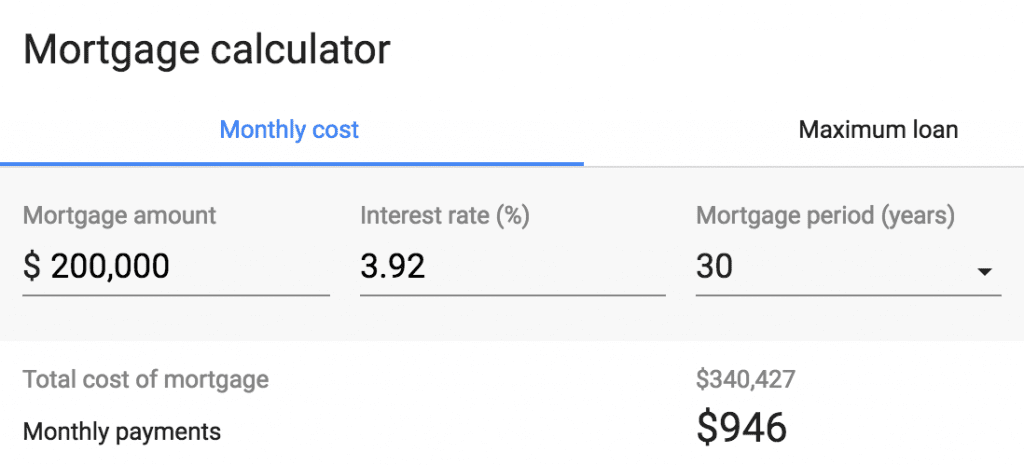

Find out what you can afford

Online mortgage calculators are extremely helpful. A simple google search will populate many results.

Get Pre-approved

Before looking for your new home, you will want to go through the pre-approval process. To achieve this, you’ll need to find a good mortgage lender.

Who are the best mortgage lenders?

A mortgage loan can be 30 years in length. You will want a relationship with a great lender. Although there is not one “best” mortgage lender, there are some that have top ratings.

consumeraffairs.com provides a list of what they call “accredited” mortgage companies. Here is their list: Consumeraffairs.com

You can also check lender reviews on Zillow.com here: https://www.zillow.com/

You can do that through this site here: Nmlsconsumeraccess.org

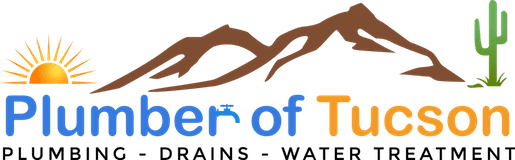

How do you find the best home mortgage rates?

Bankrate.com provides a tool for comparing home mortgages.

Alternatively, you can hire a mortgage broker. Essentially, a broker is the middleman that connects you with lenders.

A good mortgage broker can assist you in finding the best rates as they will typically have access to the largest number of options.

Where can you find a good mortgage broker?

You can search locally for mortgage brokers in your area by doing a quick “Google” search.

Alternatively, you can use broker sites such as:

Check out these different loan types.

PUT DOWN ONLY 3.5% WITH AN FHA LOAN

The Federal Housing Administration has various mortgage programs.

This loan is great for first-time homebuyers with less than perfect credit.

With an FHA loan, you may qualify for a loan with only 3.5% down.

Search for FHA loans at Portal.hud.gov

SEE IF YOU QUALIFY FOR “NO MONEY DOWN” WITH A VA LOAN

The US Dept. of Veterans Affairs helps veterans and their surviving spouse purchase new homes. When accepted, you may qualify for a “no money down” loan.

Check out more here: Benefits.va.gov

GET UNHEARD OF PERKS WITH A USDA HOME LOAN

(Also known as Single Family Housing Guaranteed Loan Program)

The US Dept. of Agriculture provides a homebuyer assistance program. The potential home needs to be located in a rural area. To determine eligibility, visit the site here: Eligibility.sc.egov.usda.gov

MAXIMIZE YOUR BORROWING WITH A HOME IMPROVEMENT MORTGAGE LOAN

- The energy efficient mortgage program- This program extends your borrowing when you purchase a property with energy saving improvements.

- HUD 203K loan- This program is for buyers who want a home they can fix up. This is an FHA-backed loan.

Look into these loans here: Portal.hud.gov

GET UP TO 50% OFF THE SALE PRICE WITH A GOOD NEIGHBOR NEXT DOOR PROGRAM

A HUD program that offers discounts up to 50% off the price of a home. If you commit to living in the home for 36 months, you may qualify for this type of loan.

Check out more here: Portal.hud.gov

GET A HOME AS LITTLE AS $1 THROUGH THE HUD DOLLAR HOME PROGRAM

When the FHA acquires a home through a foreclosure, you may be able to pick up a cheap one. The program is designed to assist lower income families to attain homeownership.

Check out more here: Portal.hud.gov

SEE IF THE GOVERNMENT CAN HELP

Fannie Mae and Freddie Mac Mortgage Backed Securities are government-backed companies that work with lenders to help with mortgage options and low down payments

How to apply for a Fannie Mae HomePath mortgage

here: Fanniemae.com

How to apply for a Freddie Mac home loan here:

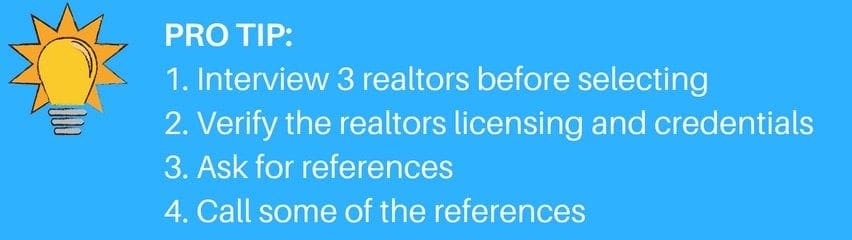

Choosing a Realtor

Selecting a real estate agent that has your best interest at heart is a desire most people have. Start by checking with friends and family to see if they recommend one. If you come up short there, the best way to achieve this, is by asking for a list of references. The trick to asking for references is not accepting a list of 3 or 4 people. If their list is lengthy, 50-100 people, then that is your realtor.

You can start your search by checking real estate agent reviews on Angieslist.com at Angieslist.com

You can find realtors by visiting Realtor.com

Alternatively, you can visit Trulia.com

Want to be your own realtor?

These online tools can help you search for your new home:

Zillow.com

Trulia.com

Redfin.com

Realtor.com

Homefinder.com

Homes.com

Understanding The Louisville MLS System louisvillerealestate.fm

Condos For Sale In Louisville Condos For Sale

You May Qualify For a First Time Home Buyer Tax Credit

The government has provided tax breaks to entice people to purchase their first home.

To learn more, check with a qualified CPA or tax advisor. You can also check the IRS website at: IRS.gov

Mistakes to Avoid

Miscalculating Other Expenses

- Property Insurance

- Property Taxes

- HOA Dues

- Maintenance

- Utility Bills

Many first time home buyers overlook these important factors when purchasing their home.

Searching for a property and then trying to get a loan

This helps you avoid making an emotional decision. Knowing what you can afford keeps things realistic and in balance.

Skipping professional help

When buying your first home, it will be important to seek professional help. A good real estate agent and a good loan officer will guide you through the process.

Using 100% of your savings on the down payment

Putting down a 20% down payment can help you skip private mortgage insurance, but it is too risky to be left with nothing after home closing. An emergency fund is essential when you own a home.

Opening new loans before the home closes

Often, lenders pull credit reports before the closing to ensure the buyer’s financial situation has not changed since the loan was approved. Buying new furniture for the home should wait, till the deal closes.

Get a survey on your property

Don’t get into a border dispute with your new neighbors. You can obtain a survey of your home to know exactly where your property line is. This will help you avoid disputes with neighbors.

Get Ready to make your bid

Check the county clerk’s office for tax information on the property.

If a seller is behind on their property tax, you have a tool to help you negotiate a good deal.

Know how a lender may view your income

If you are self-employed or, if you are paid on 100% commission, the lender will need more documentation to prove your income. Be prepared to show at least two years of solid earnings.

Understand other home costs:

Don’t get surprised by unexpected repairs and maintenance. You also want to be prepared for property tax increases.

Fannie Mae recommends no more than 28% of your gross monthly income should be dedicated to housing costs.

Think of the resale

- Don’t over improve.

- Think twice before choosing paint color.

- Don’t over customize to your taste.

Check the neighborhood for sex offenders

AZ Dept. of Public Safety provides a database to locate convicted sex offenders. Although it is not a deal breaker, it’s still nice to know who is living close to you. Check out more here: Azdps.gov

Check your commute in traffic

Often, people make decisions to move into a new neighborhood accepting the commute to work, without checking the drive time in traffic. This can be a serious mistake. Experts recommend checking the drive time in dense traffic, before selecting your new home.

Get a home inspection

Considering inspecting the home yourself? Real estate professionals highly recommend getting a home inspection for numerous reasons. But the main reason- The home inspector can reveal future surprises you may be unaware of.

When you purchase a home know the signs for water damage.

Things the realtor and home inspector may not inform you of

First, it is important to understand that your home inspector is unable to discover or reveal every flaw or potential issue with your new home.

The inspector will check for issues in areas that are accessible. The inspector is unable to check in areas such as: under the slab or inside walls.

Know what your inspector is expected to check for by visiting the American Society of Home Inspectors website (ASHI)

Do I really need to have the sewer line inspected?

Absolutely. In some cities, it is a requirement to have your sewer inspected before you can legally sell the property. The home inspector will run water down each drain to verify drainage. But what the inspector can’t see is the actual condition of the drain. Hire a plumber or sewer inspector to have the drain lines scoped.

Is testing for Radon necessary?

The EPA and American Cancer Society recommend having your new home tested for Radon.

If the home does have high amounts of Radon, don’t worry, it shouldn’t be a deal breaker. There are simple solutions for Radon exposure.

Learn more about Radon by visiting the EPA website here:

Should I test the home for asbestos?

If you have plans to renovate, testing for asbestos is a good idea. Typically, asbestos isn’t harmful unless it’s inhaled after it is disturbed and air-borne. If you have plans to knock down drywall and upgrade portions of the home, consider getting the property tested.

How likely is my home to have a lead water service line?

The use of lead water service pipes (the main water pipe that runs from the city water meter to your main shut-off valve) was very common until 1986, when Congress banned the use of lead in drinking water pipes.

If your home was built before 1986, have the water tested for lead, or get yourself a lead testing kit to test the water yourself.

Now, let’s do a quick recap of “How To Buy a House”